Gas Price Drop Masks Rise in Price for Services

But Progress on Cutting Inflation Portends Interest Rate Cuts In a Matter of Months

Sometimes a single number doesn’t tell you the whole story. That’s the case with the latest consumer price report. Last month saw prices rise 1.%. On the surface, that’s great news. But the #1 reason for that tiny increase was a big drop in the price of one item: gasoline. Gas prices fell 6%.

While the price at the pump went down, the price of many other goods as well as services went up as you’ll see in the charts at the bottom of this post. So, while you saved a bundle at the pump, all that money and a bit more was spent on items that went up in price. Unless you received a pay raise last month, you’re still falling behind.

Inflation: The Masked Bandit

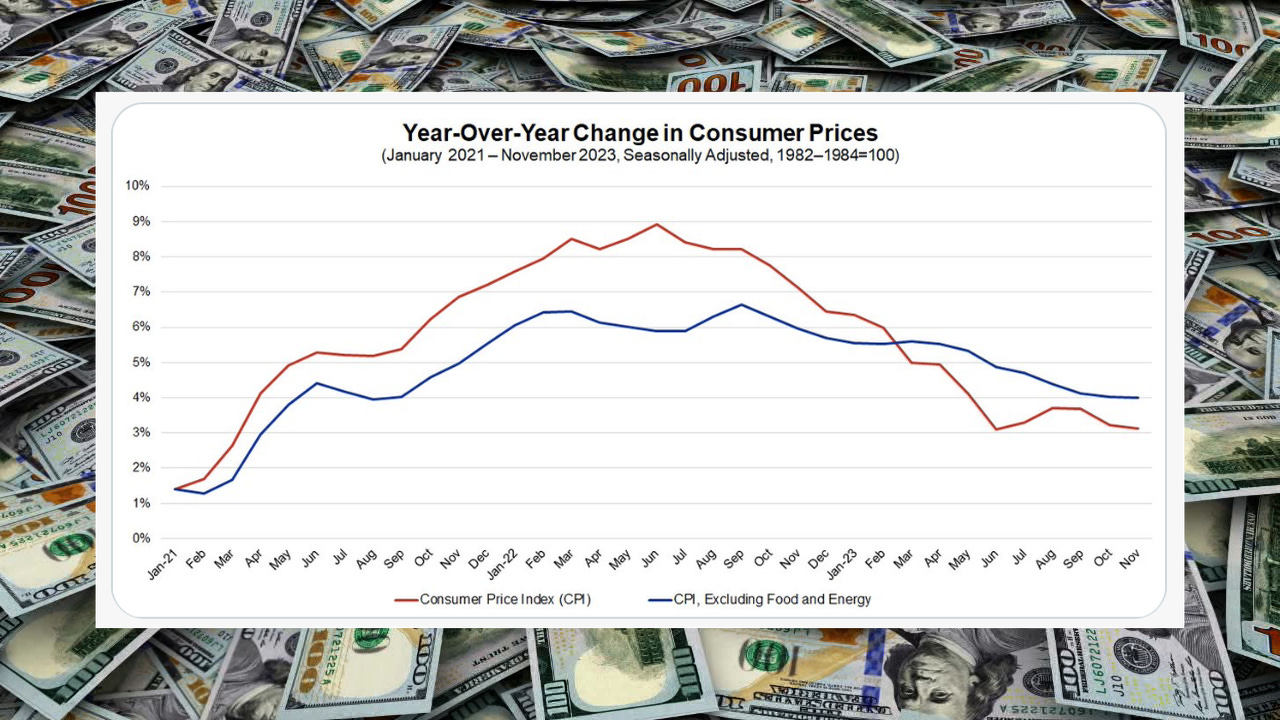

Inflation robs you of your buying power. So, it’s absolutely good news that inflation is running at less than half the rate it was a year ago. Inflation for 2022 was 8%. Over the past year prices are up just 3.1%. That’s progress. But inflation isn’t dead yet. The Federal Reserve Board won’t hold a wake for inflation until prices are increasing at an annual rate of only 2%. The 3.1% rate is more than 50% higher than the Fed’s target. More troubling is that the 3.1% number isn’t a good representation of what’s happening in the economy. As I mentioned above, the dramatic decline in gasoline prices masked the increase in prices spread throughout the economy.

What is Core Inflation and Why Does It Matter?

The Fed can’t depend on a 6% drop in gasoline every month to keep inflation under control. So, it sets policy based on what’s called “Core Inflation” — a measure that excludes energy and food from the inflation calculation. The price of energy and food are volatile, meaning they can go up and down quite a bit on a month-to-month basis. Yes, we as consumers have to pay those prices but when it comes to policymaking, the Fed closely monitors prices in other parts of the economy it believes more accurately determine the long-term structure of inflation.

How High is Core Inflation?

While the Consumer Price Index is 3.1% higher than a year ago, Core Inflation is up 4% during that time period. That’s twice the Fed’s goal of 2% inflation.

The chart below compares the Consumer Price Index (red line) to Core Inflation (blue line).

KMPG Chief Economist Diane Swonk, who briefs The Federal Reserve Board, says the Fed is concerned with the blue line (Core CPI) which is at 4%.

What’s Your Personal Inflation Rate?

That depends, in large part, on how you spend your money. The two charts at the bottom of this post show price increases and decreases in both the goods and service sectors of the economy. The decreases are shown in blue, the increases are in red. You’ll notice that there are a lot more decreases in the price of goods and more increases in the price of services.

Inflation in the services sector remains stubbornly higher than the Fed’s target. And it’s not just because of the out-of-sight prices of Taylor Swift concert tickets which go for $1,000 a seat in the nose-bleed section. Tickets for sporting events are up more than 16% in the past year. Restaurant menu prices are going up three times as fast as the price of groceries. Insurance, car repair, hospital services, and trash collection are also among the services costing more. A lot more. Last month the prices for services increased by .5% and they’re up 5.2% over the past year. And that’s the reason the Fed closely monitors the service sector of the economy because it accounts for more than 60% of the Consumer Price Index.

What’s Up and What’s Down?

The first chart shows how much prices changed for goods from October to November of this year and how much they’ve changed over the past year.

The second chart shows how much prices changed for services from October to November of this year and how much they’ve changed over the past year.

Perspective: The Outlook for Inflation and Interest Rates

Over the past year and a half, the Federal Reserve Board raised interest rates to slow down the economy in hopes of tamping down inflation. The consensus at the Fed and among private sector economists is that rates don’t need to go any higher and that current rates will continue to gently slow the economy and put it on the glide path to achieve 2% inflation. But while the Fed’s target inflation rate is 2%, Fed Chairman Jerome Powell said the Fed will begin cutting interest rates before inflation reaches that 2% target. When will the Fed begin to cut interest rates? Everyone has their predictions but nobody knows, not even the Fed. Some analysts think it may happen as soon as March. Others think May is more likely. But there’s no telling how much they’ll be cut or how often in the new year. Stay tuned.